Today's Quote: ""

New Bitcoin treasuries may crack under price pressure

2025-06-12 00:11:37

New Bitcoin treasuries may crack under price pressure

Bitcoin, the world's most valuable cryptocurrency, has seen immense growth over the years. With this growth, however, comes increased price volatility, which can cause significant pressure on Bitcoin treasuries, especially those that are newly established.

Understanding Bitcoin Treasuries

Bitcoin treasuries are essentially reserves of Bitcoin held by companies or institutions as part of their investment portfolio. These treasuries work much like any other financial reserve, but with Bitcoin as the asset. As Bitcoin's price fluctuates, so does the value of these treasuries.

Price Pressure on Bitcoin Treasuries

Emerging Bitcoin treasuries may find it challenging to cope with the extreme price volatility of the digital asset. A sudden drop in Bitcoin's price can lead to substantial losses, which is why some experts suggest that only those who can afford to lose their investment should venture into Bitcoin treasuries.

Role of Market Sentiment

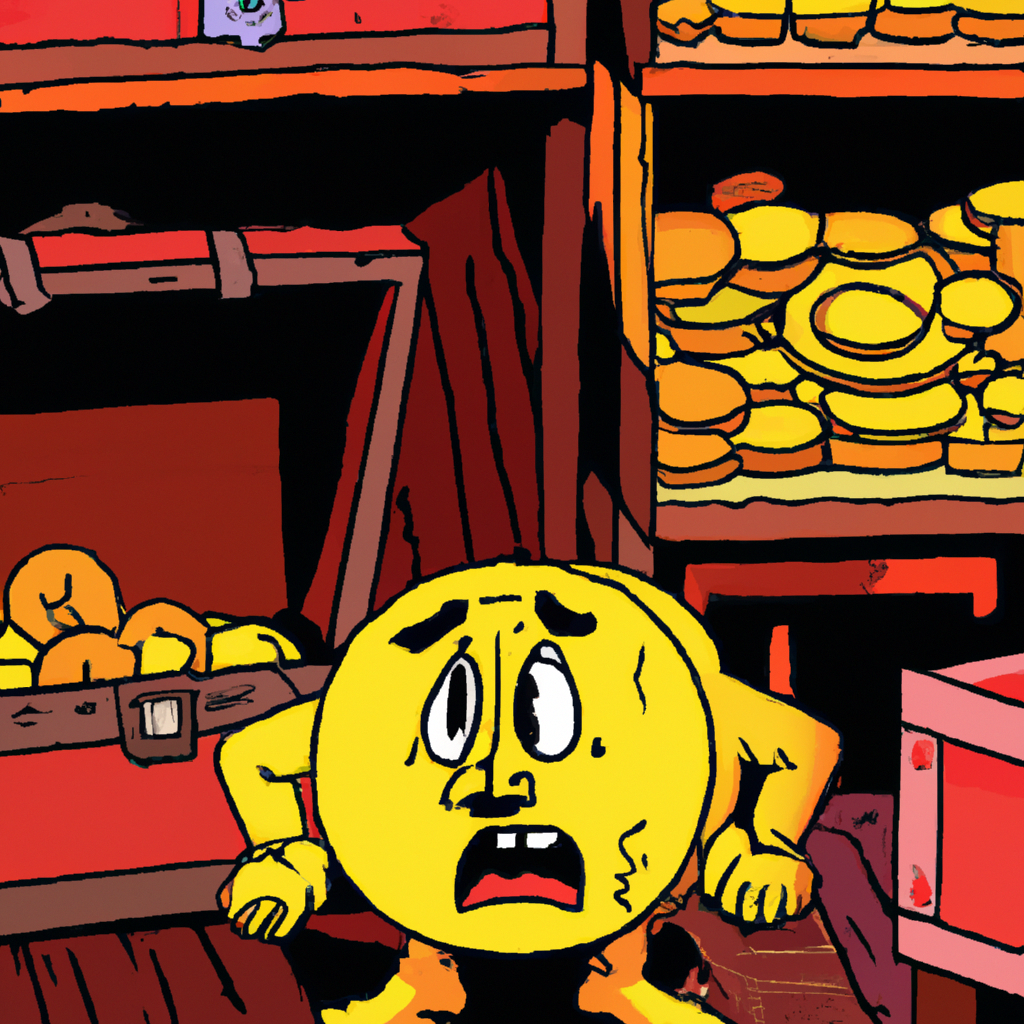

The Bitcoin Fear and Greed Index, as measured by bitcoinmeter.io, plays a crucial role in the cryptocurrency market. When fear is high, investors are more likely to sell, pushing prices down. Conversely, when greed is high, investors tend to buy more, pushing prices up. This cycle of fear and greed can add to the price pressure on Bitcoin treasuries.

Conclusion

In conclusion, while Bitcoin treasuries provide a way for institutions to tap into the potential of the world's most valuable cryptocurrency, they are not without risk. With the extreme price volatility of Bitcoin and the impact of market sentiment, new Bitcoin treasuries may crack under price pressure. However, with careful risk management and a long-term investment strategy, these challenges can be mitigated.

Disclaimer: This content is for informational purposes only and not financial advice. Always conduct your own research before making any investment decisions.